China’s central bank said it will lower the reserve requirement ratio for financial institutions when conducting some foreign exchange forwards trading to zero with effect from Monday. Under current rules, financial institutions must set aside 20% of the previous month’s yuan forwards settlement amount as foreign exchange risk reserves. “The People’s Bank of China (PBOC) will continue to maintain flexibility in the exchange rate, stabilize market expectations, and keep the yuan basically stable at reasonable and balanced levels,” the central bank said on its website. The move came after the onshore spot yuan rate ended at a 17-month high on…

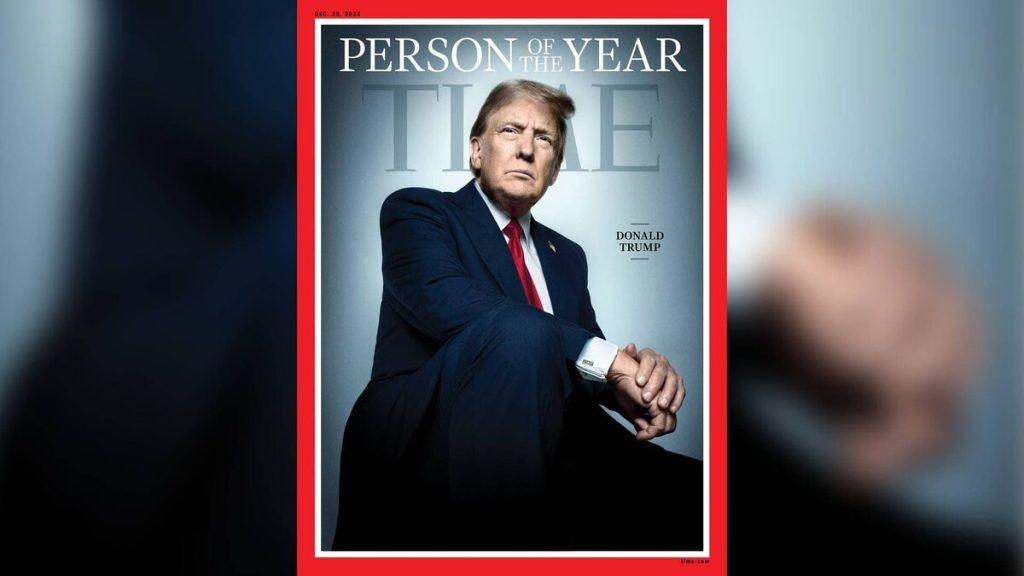

Pres. Trump 45-47 MAGA

Select Your Language !

Help Keep HO1 Safe and Online

✔️ Start Here – Direct Link

Social HO1.us

Subscribe to HO1 NewsLetter

Text & Video Translator

- HO1

- We The People

- Breaking

- DS & Fraud

- 🔱 Topics

- 🛡️ JUST IN – Classified

- 🔆 ANALYSIS

- 🔔 Politics

- 💰 Economy – Finance

- Free Access Posts

- Must Read and Watch

- 🦅 ARCHIVES

- ⚔️ DefCon 1

- World

- About

- ✔ Your Account

- HO1

- We The People

- Breaking

- DS & Fraud

- 🔱 Topics

- 🛡️ JUST IN – Classified

- 🔆 ANALYSIS

- 🔔 Politics

- 💰 Economy – Finance

- Free Access Posts

- Must Read and Watch

- 🦅 ARCHIVES

- ⚔️ DefCon 1

- World

- About

- ✔ Your Account

Comments