The European Central Bank (ECB) announced a tapering of the repurchase program on Sept. 9. One would imagine that this is a sensible idea given the recent rise in inflation in the eurozone to the highest level in a decade and the allegedly strong recovery of the economy. However, there’s a big problem. The announcement is not really tapering, but simply adjusting to a lower net supply of bonds from sovereign issuers. In fact, considering the pace announced by the central bank, the ECB will continue to purchase 100 percent of all net issuances from sovereigns. There are several problems…

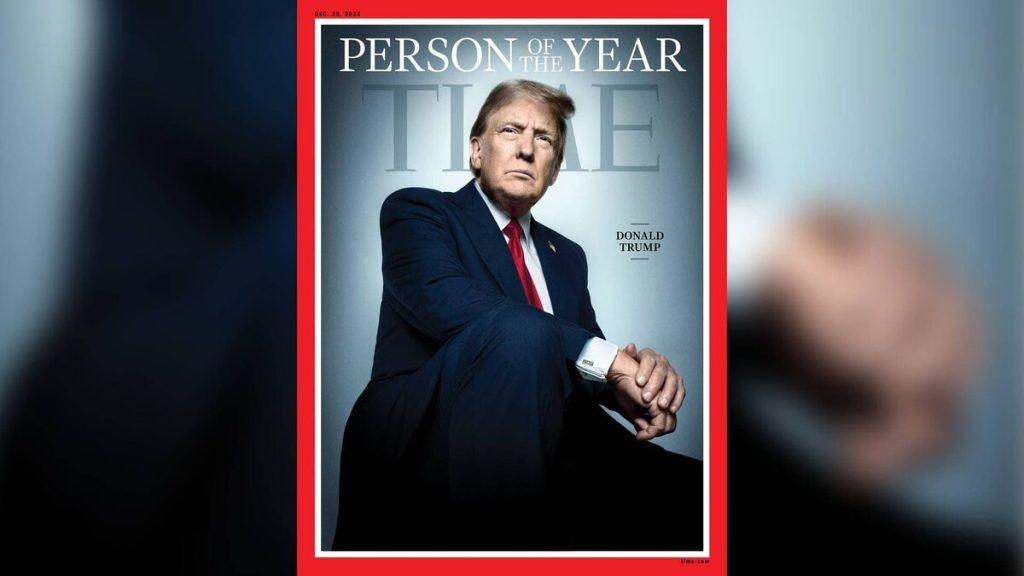

Pres. Trump 45-47 MAGA

Select Your Language !

Help Keep HO1 Safe and Online

✔️ Start Here – Direct Link

Social HO1.us

Subscribe to HO1 NewsLetter

Text & Video Translator

- HO1

- We The People

- Breaking

- DS & Fraud

- 🔱 Topics

- 🛡️ JUST IN – Classified

- 🔆 ANALYSIS

- 🔔 Politics

- 💰 Economy – Finance

- Free Access Posts

- Must Read and Watch

- 🦅 ARCHIVES

- ⚔️ DefCon 1

- World

- About

- ✔ Your Account

- HO1

- We The People

- Breaking

- DS & Fraud

- 🔱 Topics

- 🛡️ JUST IN – Classified

- 🔆 ANALYSIS

- 🔔 Politics

- 💰 Economy – Finance

- Free Access Posts

- Must Read and Watch

- 🦅 ARCHIVES

- ⚔️ DefCon 1

- World

- About

- ✔ Your Account

Comments